If you are a first-time car owner, navigating the world of car insurance can be overwhelming. With so many options and companies to choose from, it’s important to have a basic understanding of car insurance quotes before making a decision. In this guide, we’ll break down the essentials of car insurance quotes and what you need to know as a first-time car owner.

Toc

Introduction to Car Insurance Quotes

Car insurance quotes are estimates that insurance companies provide to potential customers in order for them to determine the cost of their car insurance plan. These quotes take into account a variety of factors such as your driving record, age, type of car, and location. It’s important to note that these quotes are not set in stone and can vary depending on the individual’s circumstances.

What are Car Insurance Quotes and Why They are Essential

If you’re a first-time car owner, navigating the world of car insurance can seem daunting. At the heart of it all are car insurance quotes, which are estimates of how much you’ll pay for your insurance policy. These quotes are essential because they help you understand the cost of insuring your vehicle and allow you to compare different policies to find the best one for your needs.

Understanding the Different Types of Coverage

When getting a car insurance quote, it’s important to understand the different types of coverage that may be included. The most common types include liability coverage, collision coverage, and comprehensive coverage. Liability coverage protects you in the event that you cause damage to someone else’s property or injure another person in an accident. Collision coverage covers the cost of repairs for your own car if it is damaged in an accident. Comprehensive coverage, on the other hand, covers damages to your car from non-collision incidents such as theft, natural disasters, or vandalism.

Understanding Car Insurance Quotes

Car insurance quotes typically include a breakdown of the coverage options and their associated costs. It’s important to review these quotes carefully and understand what each type of coverage entails. You may also have the option to customize your coverage by choosing different deductibles or adding on additional features such as roadside assistance or rental car reimbursement.

Factors Affecting Car Insurance Quotes

Several factors can affect the car insurance quotes you receive. These factors help insurance companies assess the risk associated with insuring you and your vehicle. Here are some of the key factors:

Driving Record

Your driving record is one of the most significant factors that insurance companies consider when providing a car insurance quote. A clean driving record with no accidents or traffic violations can result in lower premiums, as it indicates you are a lower-risk driver. On the other hand, a history of accidents, speeding tickets, or other violations can increase your premiums because they suggest a higher risk of future claims. It’s crucial to maintain a good driving record to benefit from lower insurance costs.

Age and Gender

Age and gender are also important factors in determining car insurance quotes. Statistically, younger drivers, especially those under 25, are considered higher risk due to their lack of driving experience. As a result, they tend to face higher insurance premiums. Gender can also play a role, with certain age groups of males often being charged more than their female counterparts, due to historical data indicating a higher likelihood of accidents.

Type of Car

The make, model, and year of your car can significantly impact your insurance quote. High-performance sports cars or luxury vehicles typically come with higher insurance premiums because they are more expensive to repair or replace and may be more likely to be involved in high-speed accidents. Conversely, cars with advanced safety features and a good safety rating can help reduce your insurance costs.

Location

Where you live is another critical factor in determining your car insurance quote. Urban areas with high traffic density and elevated crime rates may lead to higher premiums due to the increased risk of accidents and theft. In contrast, rural areas with less traffic and lower crime rates often see lower insurance costs. Additionally, your specific zip code can influence rates due to regional differences in insurance regulations and claim histories.

Credit Score

Some insurance companies use credit-based insurance scores as part of their assessment criteria. Research has shown a correlation between credit scores and the likelihood of filing claims, so drivers with higher credit scores may benefit from lower premiums. Conversely, drivers with lower credit scores might face higher rates. It’s advisable to maintain a good credit score by managing debts responsibly and making timely payments.

Mileage and Usage

The amount you drive annually can also affect your car insurance quote. Drivers who log more miles are generally at a higher risk of being involved in an accident simply due to the increased time spent on the road. Consequently, high-mileage drivers might see higher premiums. Similarly, how you use your car—whether for commuting, business, or personal use—can impact your insurance rates, with business use typically attracting higher premiums.

How to Obtain and Compare Car Insurance Quotes

Now that you understand the importance of car insurance quotes and the factors that can influence them, here’s how to obtain and compare quotes from different providers:

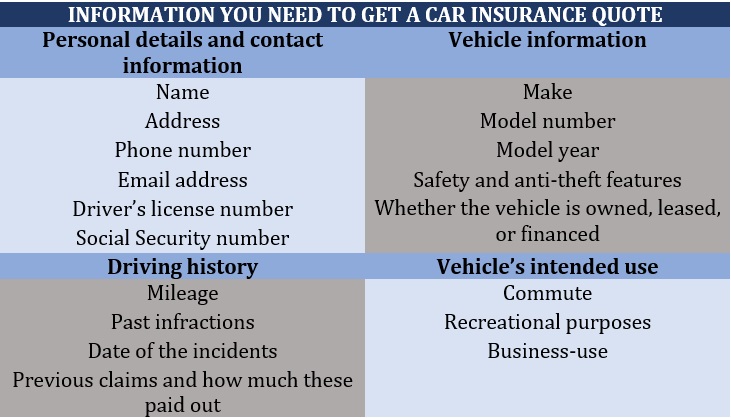

Collect Your Information

Before requesting a quote, gather all the necessary information about yourself and your vehicle. This includes your driver’s license number, vehicle make and model, driving history, and any previous claims.

Request Quotes from Multiple Providers

Reach out to at least three different insurance companies to get quotes for comparison. You can request quotes online or by calling their customer service representatives.

Review Coverage Options

Carefully review the coverage options included in each quote. Ensure they meet your needs and budget.

Understand Discounts

Ask about any discounts that may be available to you, such as safe driver discounts or multi-policy discounts. These can help lower your premiums.

Consider the Cost of Deductibles

A deductible is the amount you must pay out of pocket before insurance coverage kicks in. A higher deductible can often result in lower premiums, but make sure you can afford to cover it if an accident occurs.

Where to Obtain Car Insurance Quotes

You can obtain car insurance quotes from several sources, including:

- Insurance company websites

- Comparison websites

- Independent agents or brokers

Online

Obtaining car insurance quotes online is convenient and quick:

- Visit Insurance Websites: Most insurance companies have online quote tools. Enter your details to get an instant estimate.

- Use Comparison Sites: Websites like Insure.com or NerdWallet allow you to compare quotes from multiple insurers at once.

- Review and Compare: Look at the coverage options and prices to determine which policy offers the best value.

Through an Agent or Broker

Working with an independent agent or broker can also help you obtain and compare car insurance quotes:

- Provide Information: Give your agent or broker all the necessary information to obtain accurate quotes.

- Review Options: Your agent will present you with different coverage options from various insurers for comparison.

- Choose the Best Policy: Consider the price, coverage, and reputation of each insurer before selecting a policy that meets your needs.

In-Person

For those who prefer a more personal touch:

- Visit Local Insurance Agents: They can provide you with quotes from different insurers.

- Ask Questions: Don’t hesitate to ask about coverage details and potential discounts.

- Gather Multiple Quotes: Just like online, comparing multiple quotes will help you make an informed decision.

Tips for Finding Affordable and Suitable Car Insurance

Finding the perfect balance between affordability and suitable coverage can be challenging. Here are some tips to help you secure the best car insurance deal:

Shop Around Regularly

Insurance rates change frequently, so it’s beneficial to shop around for new quotes periodically. Comparing new quotes every six months to a year can ensure you’re not overpaying.

Bundle Policies

Consider bundling your car insurance with other policies, such as home or renter’s insurance, with the same provider. Many companies offer discounts for multiple policies.

Maintain a Clean Driving Record

A clean driving record free from accidents and traffic violations will generally result in lower premiums. Safe driving habits not only keep you safe but also help you save money.

Take Advantage of Discounts

Look out for available discounts such as good student discounts, safe driver discounts, or discounts for cars with advanced safety features. These can significantly reduce your premiums.

Install Safety Features

Equipping your vehicle with anti-theft devices, airbags, and other safety features might lower your insurance costs. Insurers often provide discounts for vehicles with enhanced safety equipment.

Opt for Usage-Based Insurance

Some insurers offer usage-based insurance programs where premiums are based on driving behavior. This could be beneficial if you have low annual mileage or exhibit safe driving habits.

Pay Your Premium Annually

If possible, consider paying your insurance premium annually instead of monthly. Many insurers provide discounts for annual payments, reducing overall costs.

Increase Your Deductible

Opting for a higher deductible can lower your premium. However, ensure you have enough funds saved to cover the deductible in case of an unexpected accident.

Improve Your Credit Score

As mentioned earlier, maintaining a good credit score can help reduce your premiums. Regularly check your credit report and take steps to improve your credit standing.

Select Appropriate Coverage Limits

Choose coverage limits that fit your needs without unnecessary extras. Ensure you have sufficient coverage, but avoid over-insuring, which can needlessly increase your premiums.

By following these tips, you’ll be better positioned to find car insurance that offers both affordability and the coverage you need to stay protected on the road.

Top Car Insurance Quotes in US 2024

Allstate

Pros: Allstate is known for its wide array of discounts and superior customer service. They offer notable benefits such as accident forgiveness, which prevents your rates from increasing after your first accident.

Cons: Compared to other insurers, Allstate’s premiums can be higher, particularly for drivers with less-than-perfect records.

Best For: Drivers looking for comprehensive coverage options and excellent customer service.

Geico

Pros: Geico is widely recognized for its affordable rates and extensive discount opportunities, including savings for federal employees, military members, and good students. Their online tools and mobile app are highly rated for ease of use.

Cons: Customer support can be less personalized, as Geico operates primarily through online and phone interactions.

Best For: Budget-conscious drivers who prefer managing their policies online.

State Farm

Pros: State Farm offers competitive rates and a large network of local agents, along with valuable add-ons like rideshare insurance for drivers who work for companies like Uber and Lyft.

Cons: In some states, State Farm’s rates may not be as competitive for high-risk drivers.

Best For: Individuals who value face-to-face interaction and those who drive for rideshare platforms.

Progressive

Pros: Progressive is praised for its Name Your Price tool, which helps drivers customize their coverage options based on their budget. They also offer several discounts, including multi-car and continuous insurance discounts.

Cons: Progressive’s rates can be higher for drivers with poor credit scores.

Best For: Drivers seeking flexible payment options and advanced online tools to tailor their insurance needs.

USAA

Pros: Offering some of the lowest premiums in the industry, USAA is exclusive to military members, veterans, and their families. They consistently receive high marks for customer satisfaction and have robust coverage options.

Cons: Availability is limited to military-affiliated individuals.

Best For: Military personnel and their families looking for exceptional service and affordability.

Nationwide

Pros: Known for the Vanishing Deductible program, which rewards safe driving, Nationwide also offers a range of coverage options and solid customer service.

Cons: Nationwide’s premiums tend to be average, not the lowest, making them less appealing to the most budget-conscious drivers.

Best For: Drivers who value innovative programs that reward safe habits.

By evaluating the pros, cons, and best-fit scenarios for these top insurers, you can make a more informed decision that aligns with your specific needs and preferences.

Conclusion

Selecting the right car insurance involves careful consideration of various factors, including coverage options, customer service, and pricing. Each insurer offers unique benefits and potential drawbacks, so thoroughly evaluating your options is crucial. Additionally, staying informed about potential discounts and consistently maintaining a good driving and credit history can significantly impact your premiums. By approaching your car insurance needs with diligence and thoughtful comparison, you can secure a policy that provides optimal protection while fitting comfortably within your budget. Remember, the ideal car insurance policy is one that not only offers comprehensive coverage but also adapts to your evolving needs as a driver.